Tax Exempt Shopping

With Prescription

Physio Store - Our Tax Exemption Policy

Certain items can be tax exempt in Canada if purchased using a prescription from a medical practitioner for use by the person named on the prescription.

Currently, only orthopaedic braces, walking boots, canes, crutches, walking poles, and compression garments are tax exempt with a valid prescription. All other products are NOT tax exempt and you will still need to pay taxes even if you have a prescription.

Even if you pay the taxes on the above items, your insurance company will reimburse you when claiming the item. Your insurance company will want you to have a prescription and an invoice showing the item has been paid, which we provide once you purchase the item.

What Items are Tax Exempt With a Prescription

Orthopaedic Braces, Supports & Walking Boots

Orthopaedic braces, Supports and Walking Boots are tax exempt if you have a prescription from a medical practitioner. According to the Canada Revenue Agency under Medical and Assistive Devices provides detailed information on zero-rated medical and assistive devices and the corresponding services for purposes of the Goods and Services Tax (GST) and Harmonized Sales Tax (HST) provisions of the Excise Tax Act (the Act). The legislative reference for the section is Part II of Schedule VI to the Excise Tax Act (the Act), unless otherwise indicated.

Orthotic and Orthopaedic devices

Sch. VI, Part II, s 23

39. As a result of amendments to section 23, a supply of orthotic and orthopaedic devices is zero-rated when the device is custom-made for an individual or when supplied on the written order of a medical practitioner for use by a consumer named in the order. The supply of a spinal or other orthopaedic brace is zero-rated under this provision. As a result of these amendments, all custom made orthopaedic and orthotic devices are zero-rated without the need of a medical practitioner’s written order. However, other orthotic and orthopaedic devices are zero-rated only when they are supplied under a prescription by a medical practitioner for use by a consumer named in the order. Therefore, items such as cradle arm slings, cervical collars and knee braces are taxable at 7% or 15% unless purchased on the written order of a medical practitioner for use by a consumer named in the order or made to order for an individual. The amendments apply to supplies for which all of the consideration becomes due or is paid without having become due on or after May 14, 1996.

Canes, Crutches and Walking Poles

Canes and Walking Poles are tax exempt if you have a prescription from a medical practitioner that specifically shows the individual requires the cane or walking pole due to an identified disability.

Crutches by there very nature are designed for individuals with a disability and therefore are tax exempt without the need for a prescription.

According to the Canada Revenue Agency under Medical and Assistive Devices provides detailed information on zero-rated medical and assistive devices and the corresponding services for purposes of the Goods and Services Tax (GST) and Harmonized Sales Tax (HST) provisions of the Excise Tax Act (the Act). The legislative reference for the section is Part II of Schedule VI to the Excise Tax Act (the Act), unless otherwise indicated.

Canes or Crutches

Sch. VI, Part II, s 27

45. Supplies of crutches and canes that are specially designed for use by an individual with a disability are zero-rated. Specially designed canes include quad canes and forearm canes. Crutches are zero-rated since they are by nature specially designed for use by individuals with a disability. A supply of a cane (including walking sticks) that cannot be identified as specially designed for use by an individual with a disability is taxable.

Compression Garments and Stockings

Stockings

Sch. VI, Part II, s 35

51. Effective April 24, 1996, a supply of graduated compression stockings, anti-embolic stockings or similar articles is zero-rated when the stockings or articles are supplied on the written order of a medical practitioner for use by a consumer named in the order. This amended provision ensures that the articles supplied under a prescription issued to a consumer are zero-rated regardless of who initially receives the supply.

Specially designed clothing

Sch. VI, Part II, s 36

52. Effective April 24, 1996, a supply of clothing that is specially designed for use by an individual with a disability is zero-rated when the clothing is supplied on the written order of a medical practitioner for use by a consumer named in the order. This amended provision ensures that the articles supplied under a prescription issued to a consumer are zero-rated regardless of who initially receives the supply.

How To Waive The Taxes On Your Order!

In order to waive the taxes on your items, find the product you are interested in. You will see a Tax Free with Prescription logo on the product page of the item you are interested in.

If this item is not tax free, you will not see this box and will be unable to purchase tax free. You must see this box on your item in order to get taxes removed with a prescription.

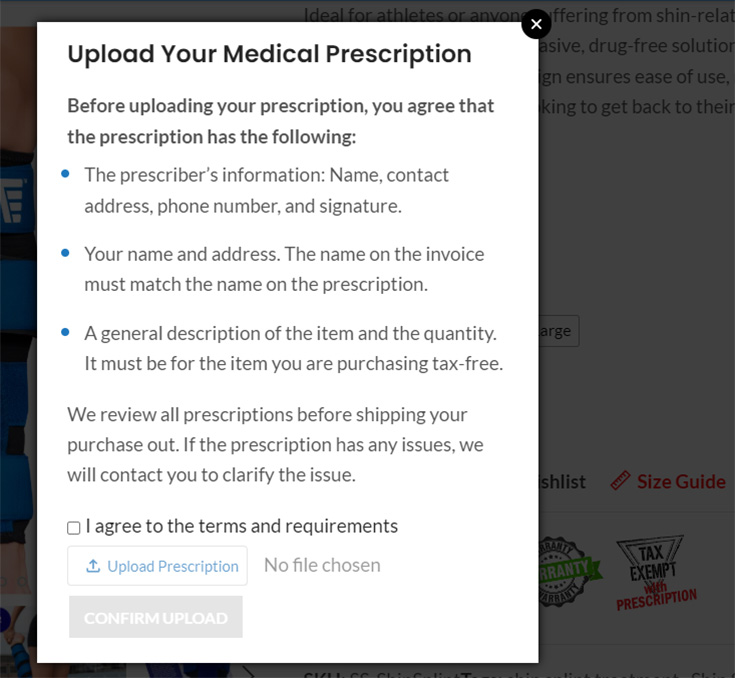

Click the link and read the directions in the pop-up window. You will be asked to upload your prescription. Once your prescription has been uploaded you will immediately be able to purchase that item tax free. We do take a look at the prescription to confirm it meets the criteria list below:

The prescription must have the following:

- The prescriber’s information: Name, contact address, phone number, and signature.

- Your name and address. The name on the invoice must match the name on the prescription.

- A general description of the item and the quantity. It must be for the item you are purchasing tax-free.

We review all prescriptions before shipping your purchase out. If the prescription has any issues, we will contact you to clarify the issue.

Example Prescription Upload Box

Below is an example of the pop-up for uploading your medical prescription!

Ask A Question

Ask A Question

Tax Exempt Shopping

Tax Exempt Shopping

Get Clinical Pricing

Get Clinical Pricing

Affiliate Program

Affiliate Program

Retail Stores

Retail Stores

Health Hub

Health Hub

Shipping Policy

Shipping Policy

Returns/Exchanges

Returns/Exchanges

About Us

About Us

Contact Us

Contact Us

BIOFLEX P120 Light Therapy System

BIOFLEX P120 Light Therapy System